We’re not getting the home we previously blogged about. Our due diligence revealed two major concerns, one of which would have eventually cost $10,000 to $40,000 to resolve and the other which endangered the home’s amazing view, which was the home’s greatest asset. We were still willing to buy the house, but not at the agreed-upon price. We asked for a 3% discount, which we thought was more than fair, but the sellers disagreed and the contract was cancelled by mutual agreement.

That was the only home currently on the market that we liked enough to consider moving from our already nice (but small) home. We began to wonder if we had made the right choice by not letting go of the 3% difference. Would we forever be trapped in a small house with nowhere to put our $100 cabinet? We had what investors call fear of missing out (FOMO).

Although Dave is a technical writer, he’s spent almost his career working for software startups and other investment products that often go through cycles of FOMO buying (“the price is going through the roof!”) and selling (“it’s going to crash!”), so he’s very familiar with FOMO’s emotional rollercoaster and the risk it creates of making hasty decisions. He also knows that one way to deal with FOMO is to attempt to quantify the risks of missing out; if the risk is small, then there’s no reason to fear.

For home buying, we decided to calculate roughly how long it would be until another great house would come to market. We found a listing of every house in our target area sold in the last three years that met our main criteria. We then looked through pictures and details and compiled a list of homes we think we would’ve bought. There were 18 homes in 36 months, indicating a house we would be willing to buy comes to market every two months on average.

That eliminated our fear. We’re not missing out on much if we only need to wait an average of two months until our next opportunity. Also useful, we found a lot of homes (including sales in the past six months) that were better value for money than the home we tried to buy. It convinced us even further that we were wise to cancel.

Better informed than before and steeled against FOMO, we’re back on the hunt for a new home in Hilo.

Dork appendix

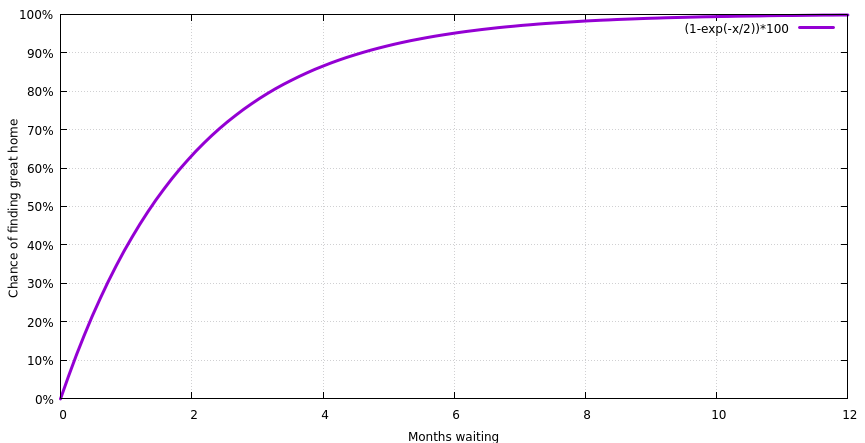

Although our research indicates that a new candidate home will come to market every two months on average, the actual amount of time we’ll have to wait is better described by a poisson distribution:

Leave a comment